colorado estate tax rate

In fact 100 of property tax revenue stays within the county in which it is collected meaning none of it goes to the state. When someone dies leaving behind property in the state of Colorado its possible for an estate tax to apply to it.

State And Local Sales Tax Deduction Remains But Subject To A New Limit Teal Becker Chiaramonte Certified Public Accountants

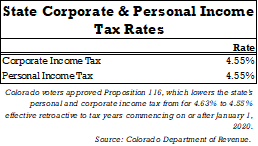

Colorado has a 455 percent corporate income tax rate.

. Get Accurate Colorado Records. For the 2021 tax year Colorado has a flat income tax rate of 45. Property Tax Information Search for real and personal property tax records find out.

The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. Counties in Colorado collect an average of 06 of a propertys assesed fair.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 70000 can claim this. The taxation rate of a motor vehicle is 2 percent.

We dont make judgments or prescribe specific policies. Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

An estate is the collection of property you leave. The 2022 state personal income tax brackets. In other words if your vehicles fair market value is 2000 and your local property tax.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 16 hours agoLEXINGTON Ky. The average effective tax rate for the county is 47 which is.

It was lowered from 455 to 45 because of a high fiscal year revenue growth. Property taxes in Colorado are definitely on the low end. State wide sales tax in Colorado is limited to 29.

WKYT - A property tax increase in Fayette County could be recalled. Ad Access Tax Forms. Colorado sales tax rate.

Estate Taxes in Colorado. If youve already filed your Colorado state income tax return youre all set. Ad Find The Colorado Property Tax Records You Need In Minutes.

In Colorado property taxes are used to support local services. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. A percentage of 802896 was used.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. There are jurisdictions that collect local income taxes.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. For questions or additional.

Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein. Youll receive your Colorado Cash Back check in the mail soon. The pandemic caused the value of used cars and trucks to increase by 33 on average.

However if the decedent owned. Colorado imposes a sales tax rate of 290 percent while localities charge 475. Colorado also has a 290 percent state sales tax rate a max local sales tax rate.

Complete Edit or Print Tax Forms Instantly. Visit Our Website For Records You Can Trust. The good news is that since 1980.

They will average around half of 1 of assessed value. Until 2005 a tax credit was allowed for federal estate. Get information on property taxes including paying property taxes and property tax relief programs.

Colorado Income Tax Range. Eagle County Property Tax Rate. See what makes us different.

2 days agoProperty tax bills due in Fairfax Co but theres some relief for car owners. Eagle County has one of the lowest property tax rates in the state of Colorado. A state inheritance tax was enacted in Colorado in 1927.

In September the Fayette County School Board voted to increase the rate by 25 per. The assessment rate for all residential real property other than multi-family residential real property is temporarily reduced from 715 to 695 for the next 2 property tax years.

Colorado Estate Tax Everything You Need To Know Smartasset

State Local Taxes Denver South

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax The Ultimate Guide Step By Step

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Colorado Estate Tax The Ultimate Guide Step By Step

Hawaii Sales Tax Rate Rates Calculator Avalara

Disabled Veteran Property Tax Exemptions By State And Disability Rating

How Do State And Local Sales Taxes Work Tax Policy Center

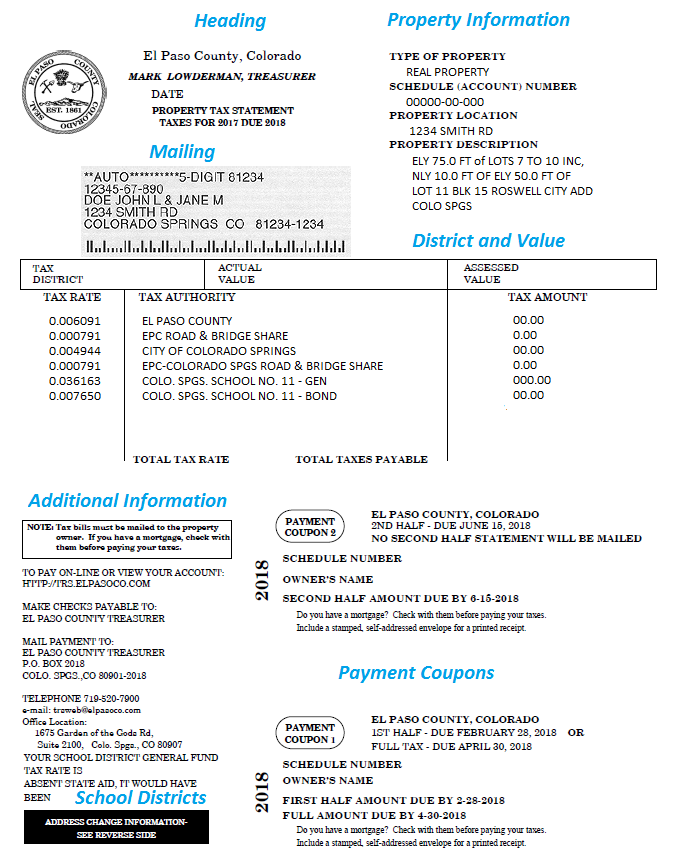

Property Tax Statement Explanation El Paso County Treasurer

Individual Income Tax Colorado General Assembly

Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2022 Free Investor Guide

What States Do Not Have Property Tax Quora

Estate Tax Definition Tax Rates Who Pays Nerdwallet

Where Not To Die In 2022 The Greediest Death Tax States

Creating Racially And Economically Equitable Tax Policy In The South Itep